A Personal Message From Our CEO to Small Business Owners

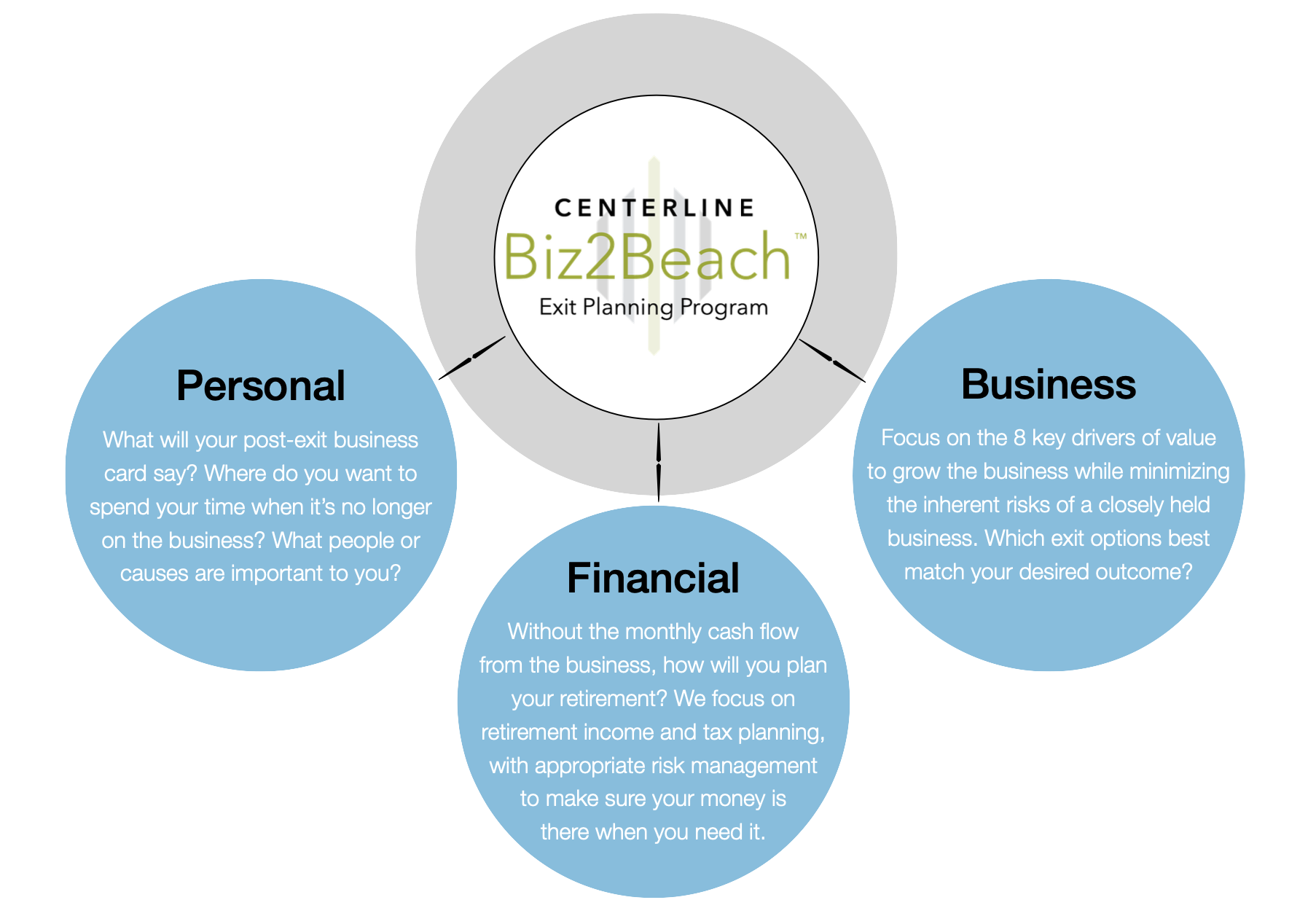

Like you, I am a small business owner who has poured my heart and soul into my business. It’s hard for me to imagine life without Centerline Wealth Advisors. However, we will all one day transition out of our business and begin a new adventure. Exiting a business can be an emotional, confusing, and complicated process. Just thinking about it causes most owners to procrastinate and delay the planning process. Having worked with business owners for years – and being one as well – I understand the concerns and confusion around the best way to begin – and the best way to succeed. So at Centerline we make it easy for owners by introducing them to our Exit Planning program Biz2Beach™.

Our Biz2Beach™ program helps you build value by showing you how to put systems in place to improve performance now, as well as how to reduce the hidden risks most businesses have. Our Exit Planning program has clear steps and deliverables that will help make an oftentimes overwhelming process much more manageable. From developing a financial plan to figuring out how you will pursue your passions in retirement to making sure your legal affairs are in order, Centerline Wealth Advisors helps you take specific steps to plan for your exit, allowing you to enjoy the wealth you have spent a lifetime creating.

Preparing for Your Exit and Beyond

The vast majority of business owners fall short in preparing for their eventual exit. This may explain why 75% of them regret their decision a year after they sell. Once you start the exit planning process you will be ahead of the 49% who have done nothing. With Centerline’s exit planning advisors at your side, we can make sure you are one of the few business owners who is truly ready – and fully prepared – to exit their business… with a plan for what comes next. Since Exit Planning is good business strategy now, the sooner you begin this process, the more valuable it becomes for you and your business.

Freedom Score is a 10-minute, online questionnaire that evaluates your financial readiness to fund the next phase of your life after your business. Freedom Score calculates your Freedom Point – when the sale of your company will generate enough to fund your desired lifestyle for the rest of your life. Discover how to reach financial independence, de-risk yourself financially, and live worry-free in the next chapter of your life. Get Your Freedom Score.

Exit Planning Articles & Whitepapers

Give us a call at (502)242-1561 or send an email to info@centerlinewealth.com if you would like to learn more about how we can help you meet your goals.