Mission

Centerline Wealth Advisors was launched with a singular mission: to provide sound, insightful guidance as fiduciaries to our client families.

To fulfill our mission, we leverage our profound experience in the financial and investment areas, our fluency with advanced technology and our dedication to cultivating strong and lasting client relationships. The financial plans we develop are sensible, intelligent and straightforward. Comprehensive in scope with a long-term perspective, our plans address the precise needs and objectives of each client family…today and for future generations.

Client Experience

The Centerline Commitment: Client-First. Client-Focused.

The Centerline Commitment: Client-First. Client-Focused.

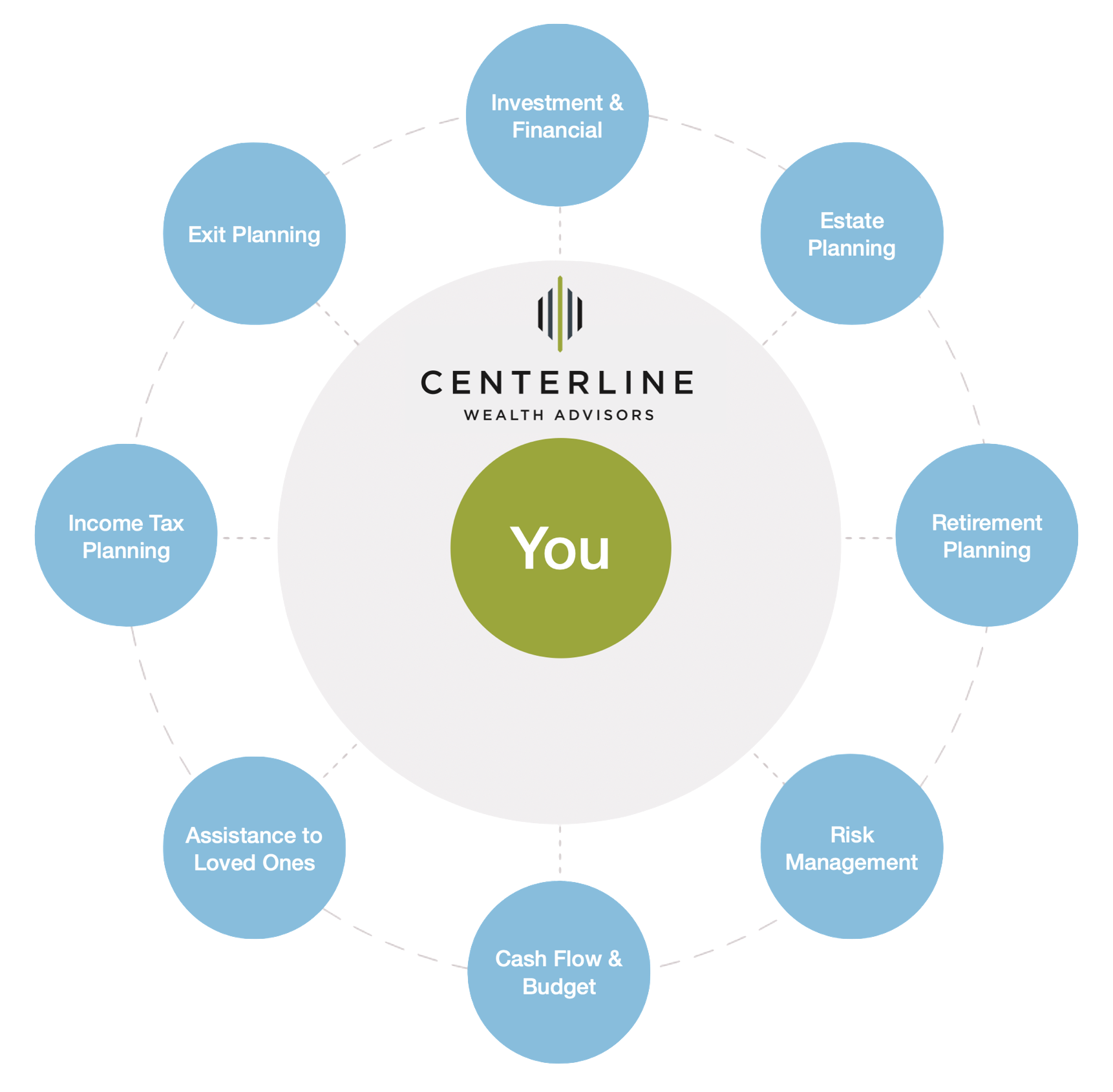

It’s no wonder our clients are successful – they work hard and lead lives abundantly full of family activities and career obligations. They’re busy, talented and smart so they realize that turning to experts for help building and managing their wealth makes sense. Not only do we handle investment planning on their behalf, we assist with tax strategies, cash flow, insurance, estate planning and much more, so they are free to enjoy the success they’ve achieved.

It’s no wonder our clients are successful – they work hard and lead lives abundantly full of family activities and career obligations. They’re busy, talented and smart so they realize that turning to experts for help building and managing their wealth makes sense. Not only do we handle investment planning on their behalf, we assist with tax strategies, cash flow, insurance, estate planning and much more, so they are free to enjoy the success they’ve achieved.

Our central – and only – focus is on fulfilling the needs, goals and objectives of our clients in a way that’s comfortable for them. We forge long-term collaborative relationships with our families, their immediate and extended families, as well as lawyers, accountants and the other professionals who represent them. We recommend only those investments that are in their best interests — not the interests of a broker or brokerage firm.

We deploy advanced technology to coordinate daily operations, recordkeeping and reporting. We communicate regularly through an informative e-newsletter, topical webinars and one-on-one meetings throughout the year.

At Centerline Wealth Advisors, we consider our client relationships personal partnerships characterized by accessibility, objectivity and transparency. As a firm independently owned and operated by individual advisors, we have a powerful sense of personal accountability, integrity and a fiduciary responsibility to put our clients first…always.

Financial Planning

Intelligent, Cohesive Design

The financial plan is the foundation upon which success is built; it is also the cornerstone of what sets us apart as wealth advisors. We devote substantial time and attention to securing a meticulous grasp of your aspirations and objectives, your current lifestyle and the one you envision for the future. We consider your family dynamics as well as any business succession plans, charitable or legacy intentions you may have…and much more.

The result of our thorough process is a comprehensive financial plan customized to your specific needs and goals. Going through our process to work on your personal plan conveys peace of mind and confidence in preparing for your financial future.

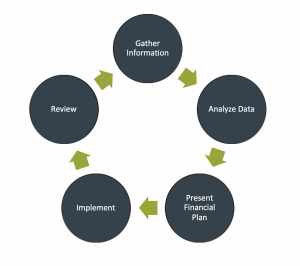

Our Planning Process

- Gather Information

We will ask you to do some “homework” and gather information like your company benefits, retirement statements, any investment or savings statements, insurance policies, loans or debt statements, etc. We want to understand the full picture as to how your financial life stacks up. Your finances are only part of the equation. We also want to understand your financial needs, your longer-term objectives, and the personal values that guide your decisions. We want to know how you envision your future and what goals you hope to achieve. - Analyze Data

We will analyze the data you have provided us in order to build a custom financial plan that helps you visualize your goals and provide a clear path to pursue them. Our work includes illustrating alternative scenarios and so we can suggest adjustments for you to consider in order to make your goals more attainable. - Present Financial Plan

We will present you with a comprehensive strategy, tailored to your short- and long-term objectives, your personal values and your life goals – everything that matters to you. Your plan may include managing debts, building a budget you can adhere to, optimizing employer benefits, identifying what is most at risk and which types of insurance you should consider, discussing the importance of a will and other estate plan documents, and many additional items. We will have designed a roadmap for you, but you are always in the driver’s seat. - Implement

Our team will help you implement the important decisions you make and the strategies you choose. We understand how busy your life is, so we will track your progress towards the goals in your financial plan, and we help you prioritize and implement agreed upon actions. - Review

We want to meet and review the financial plan and track your progress with you. Life changes and we routinely update your financial plan and goals to take those changes into account.

Portfolio Manager Selection

Our Guiding Principles: Patience and Discipline

The level of due diligence we perform in screening portfolio managers is virtually unprecedented in our industry. Our high standards required that, in addition to using independent resources, we develop a proprietary process for selecting managers. Not only does the process we engineered differ significantly from those of other Advisors’ firms, it has proven extraordinarily effective.

The level of due diligence we perform in screening portfolio managers is virtually unprecedented in our industry. Our high standards required that, in addition to using independent resources, we develop a proprietary process for selecting managers. Not only does the process we engineered differ significantly from those of other Advisors’ firms, it has proven extraordinarily effective.

We now use our own specially-designed filters to track potential portfolio managers on a quarterly basis. We conduct a detailed background analysis and interview most managers personally. This equips us to identify those managers, portfolios and funds that exhibit consistent performance over the long term. The result is the promise that we actively monitor, review and protect your interests. We don’t try to time the market, reverse direction quickly or shift unexpectedly from our initial recommendations. Experience has amply demonstrated that complex solutions and overactive trading can disrupt well-crafted plans and limit future opportunities. As is often the case, quick fixes for short-term success fall short of expectations. It is a measure of both our expertise and our commitment to our clients that our own personal portfolios include many of the same investments we recommend to clients.

Over time, we reduce overexposure in one area and maximize the benefits diversification affords. We purposely select assets that hold greater long-term potential and are well worth the patience this time horizon requires.

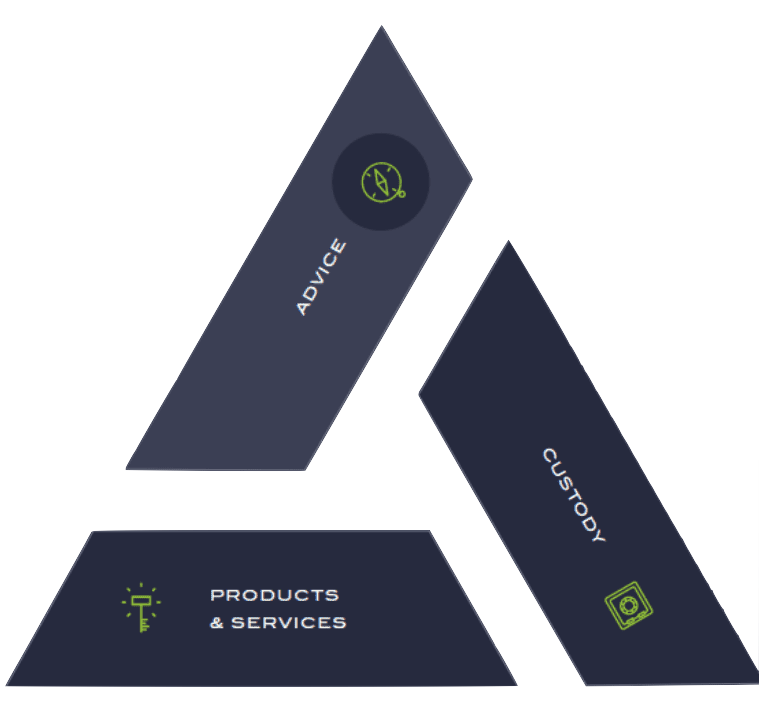

Triangulation of Advice

In starting our own independent firm, we share the same entrepreneurial spirit many of our clients possess. This independence manifests itself in a variety of critical ways.

Among the most important is how we’ve separated from one another the three key aspects of our business: advice, custody of client assets and the financial products and services. At larger wealth management firms and banks, these are traditionally linked. Clients are usually offered what makes the most business sense to the company serving them—and not necessarily the most sense for their financial lives. By completely unlinking these offerings in ways that others don’t, we embrace a more elegant, client-focused model we call “The Triangulation of Advice.” As a result, our clients can expect:

Objective advice:

We provide advice that is 100% objective, transparent and free from outside influence. As fiduciaries for our clients, we are legally bound to place their interests above everything else we do.

Independent custody of client assets:

We have selected Charles Schwab to hold all client assets on our behalf. This selection was made on a completely objective basis—we have no affiliation with or commitment to Charles Schwab. As of now, we believe it is the best firm for the job; should that change, we will find a different custodian to serve our clients.

Greatly expanded products and services:

We maintain a strategic partnership with Dynasty Financial Partners, a firm that gives us unfettered access to some of the industry’s leading products and services. Instead of being captive to one company, our clients benefit as we seek the absolute best solutions for their comprehensive planning needs including opportunities in the world’s top capital markets, advantageous lending solutions, investment banking relationships, asset management strategies, liability risk mitigation, estate planning, and much more.

As independent advisors and fiduciaries, we are uniquely equipped to realize plan goals because our advice is based on the strategies and investment choices that are optimal for each client. As a result, we can operate on a simple fee structure that reflects a percent of total assets managed. At Centerline, we believe that it’s only when our clients succeed that we do.