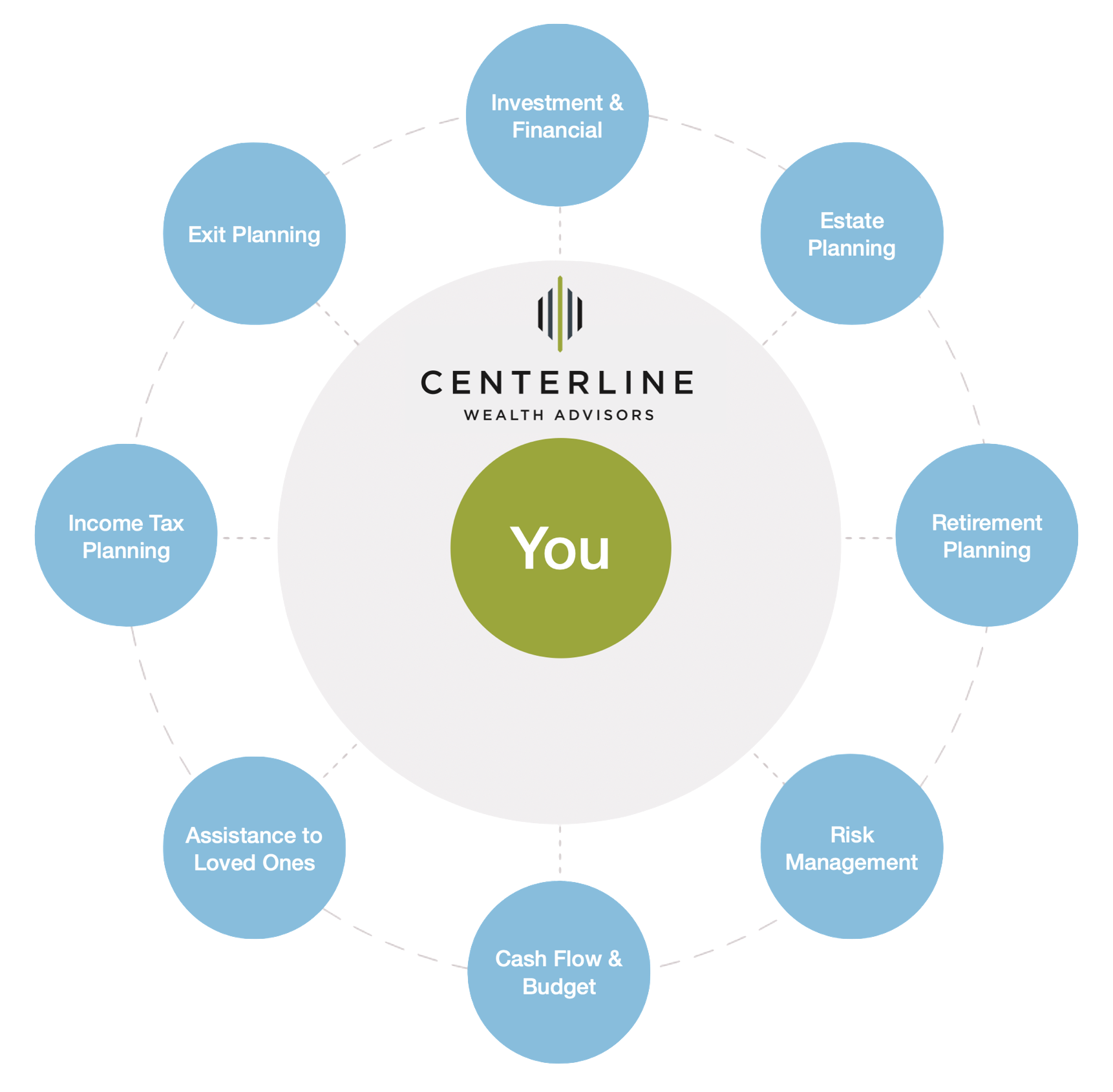

Core Services

At Centerline Wealth Advisors, a large portion of our client base includes residents, attending, and retired physicians, so we have a very good understanding of the financial challenges that are particular to the medical field. Meaningful compensation doesn’t begin until the mid-30s, if not later, and it’s easily offset by the significant debt accrued since medical school. While income can rise to significant levels, the career window to earn enough for retirement is shorter than average, usually only 30 years.

Against this backdrop, we know medical professionals are especially short on time, and the opportunity to manage their financial situation effectively is often sacrificed. To solve this issue, we work closely with you, always in an objective fiduciary capacity, to build effective and robust financial plans, tailored to your specific personal circumstances. We use a proven process to develop a roadmap to help you and your family pursue a clear path to achieving your financial and life goals.

Our Core Services take you through the process of crafting a personal financial plan to analyze all areas of your financial life.

Areas of Focus for Physicians

In addition to the Core Services we offer all clients, our experience working with Physicians and Medical Professionals has helped us identify specific areas of focus. We work with you, hand in hand, in these areas with the goal of enhancing your personal and financial life.