What is the Debt Ceiling?

The Debt Ceiling is the amount of money the US Department of the Treasury is authorized to borrow to pay the nation’s bills. These bills include Social Security, Medicare, and interest on outstanding national debt. Congress regularly raises the US Debt Ceiling so the US can borrow more, but occasionally this process becomes political.

When is the Deadline to Raise the Debt Ceiling, or the “X-Date”?

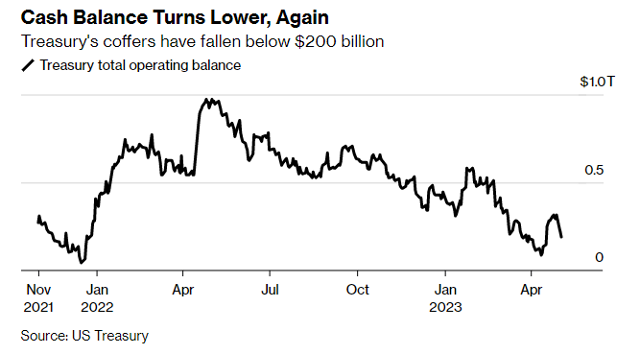

The current Debt Ceiling is roughly $31.4 Trillion, and the US hit that borrowing limit in January 2023. However, the US Treasury can use “extraordinary measures” to continue paying its bills in the short-term, including deferring contributions to pension funds. Incoming tax receipts from the April Tax deadline will raise the level of cash on hand at the Treasury, but eventually the Debt Ceiling will need to be raised. After reviewing Tax Receipts, the Treasury has greater clarity on when it would run out of Cash and technically default (known as the “X-Date”).” Treasury Secretary Yellen recently warned the X-Date could hit as early as June 1st.

When Happens Between Now and the X-Date?

All eyes turn to lawmakers. After Yellen’s announcement, President Biden announced a May 9th meeting with top Congressional leaders including House Speaker Kevin McCarthy. Further complicating matters, the House in only in session 12 days this month, while the Senate is in session 14 days (with only 7 of those days overlapping). A last resort option could be President Biden invoking the 14th Amendment and raising the Debt Ceiling on his own. There remains much uncertainty about the legality of such a move.

What if Congress doesn’t Raise the Debt Ceiling in Time?

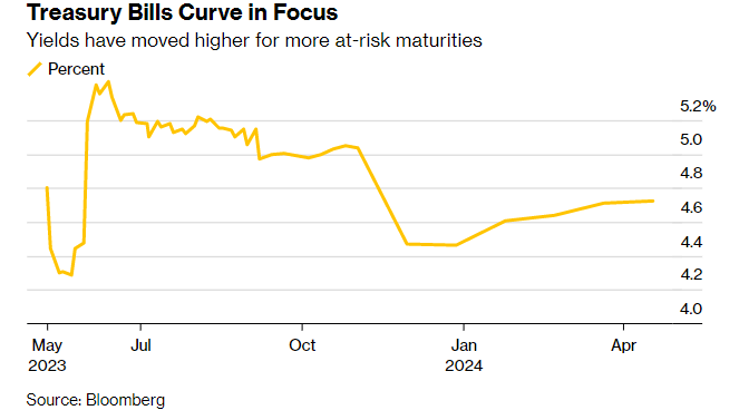

The consequences of the US not raising the Debt Ceiling in time would be unprecedented, as the US has never intentionally defaulted on its debt. Investors are currently demanding a significant premium for Treasuries maturing around the X-Date, as those Treasuries could technically not be re-paid on time in the event of a default. Currently a 1-month Treasury is yielding 5.4% – the highest level in decades.

Along with delayed interest payments for certain Treasury holders, other significant consequences of a default could include:

- Missed Paychecks for Federal employees

- Job Losses

- Delayed federal payments to Americans (i.e. Social Security)

- Selloff in the Stock Market

- Spike in Borrowing Costs for Consumers, including Mortgage Rates

- Downgrade of US Treasuries

- Drop in GDP and a Recession

When was the Last Time the US Nearly Defaulted?

The 2011 Debt Ceiling Crisis was the last time the US came close to intentionally defaulting, as Congress raised the Debt Ceiling just days before the X-Date. At that time, Congress was so gridlocked that Standard & Poor’s downgraded the AAA credit rating of US Treasuries. During this crisis, the S&P 500 fell nearly 17% in less than a month.

In summary, we expect the Debt Ceiling to be raised before the X-Date, which could occur sometime in June. Nonetheless, the upcoming negotiations between lawmakers may not produce a resolution until the eleventh hour, resulting in volatility and political noise. Still, the political fallout of an intentional default remains too risky for both Republicans and Democrats, and a deal remains the most likely outcome.

Sources: Bloomberg, CNBC, Wall Street Journal and Dynasty Financial Partners

This message is intended for the exclusive use of members or prospective members considering joining the Dynasty Network of registered investment advisers. The views expressed in the referenced materials are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance; actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Certain information contained herein has been obtained from third-party sources and has not been independently verified. The information shared in this document should not be construed as an attempt to sell or solicit any products or services nor should it be construed as legal, accounting, tax or other professional advice.